The last few years have rocked the U.S. economy and workforce. COVID-19 prompted lockdowns and the shuttering of storefronts and restaurants across the country. It disrupted where, when, and how Americans work, and also altered consumer behaviors around finances, healthcare, shopping and beyond. It catalyzed technological adoption, including the usage of digital collaboration tools for teams and friends alike. And today, the development and growing use of generative artificial intelligence (A.I.) continues to change the landscape for the future of work.

In combination with the pandemic, geopolitical tensions over the last few years–from the US-China conflict to the Russian invasion of Ukraine, have wrought havoc on global trade and supply chains leading to shortages and inflation.

Yet despite the economic rollercoaster, the last few years have fostered something remarkable: more people than ever are starting up businesses. In fact, entrepreneurship has been surging since the pandemic: in 2021, a record 5.4 million applications were filed to start a U.S. business, and in 2022, 5.1 million were filed. This growing group of business owners are critical to the American economy. Small businesses historically represent 99.9% of all U.S. businesses; create two thirds of net new jobs; and account for 43.5% of our GDP. Yet while the surge in new business formations represent optimism about an owner’s economic prospects, these owners continue to grapple with an uncertain economic and sociopolitical landscape, from inflation to labor shortages and geopolitical uncertainty.

A new study from SimplyWise explores economic sentiment in the U.S. today by comparing the economic outlook of this growing group of small business owners (SBOs) to the rest of the American workforce (which we will refer to in this report as “non-SBOs”).

Methodology

The August 2023 SimplyWise Small Business Confidence Index was conducted as an online, random sample survey of 1,175 American adults (age 18+). The survey was fielded August 11-12, 2023. It was intended to explore sentiment around the outlook of small business owners and sole proprietors given the COVID-19 pandemic and current economic and political uncertainty.

SimplyWise is a technology company that uses A.I.to help over 250,000 U.S. small business owners, sole proprietors and freelancers organize all their important information and make better financial decisions.

Key Takeaways

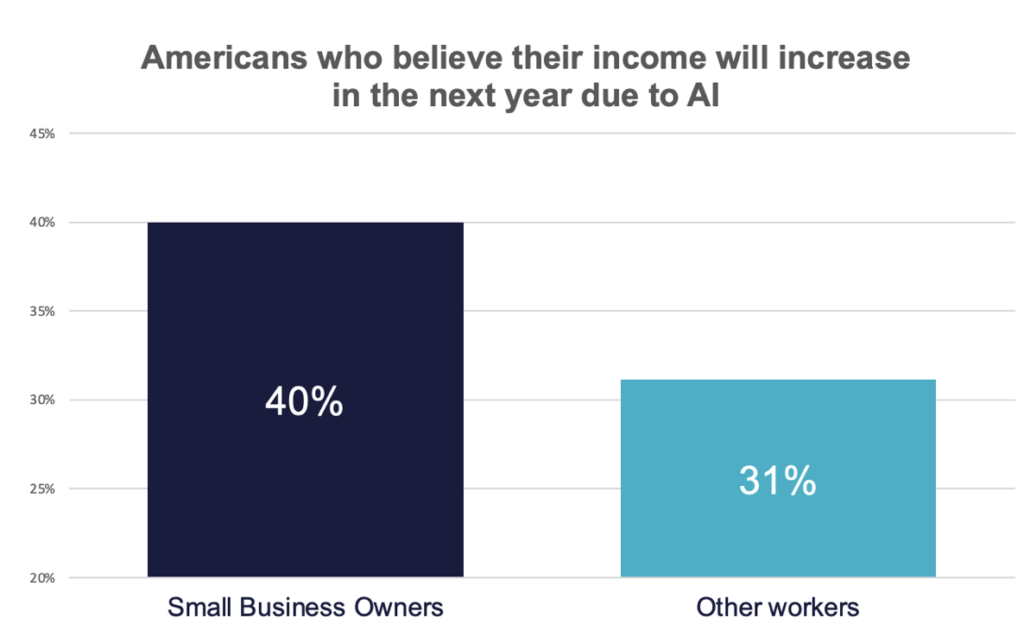

- 40% of Small Business Owners (SBOs) believe advances in Artificial Intelligence (A.I.) will increase their income in the next 12 months. This is compared to 69% of American workers who believe their income will stagnate or decrease in the next 12 months due to AI.

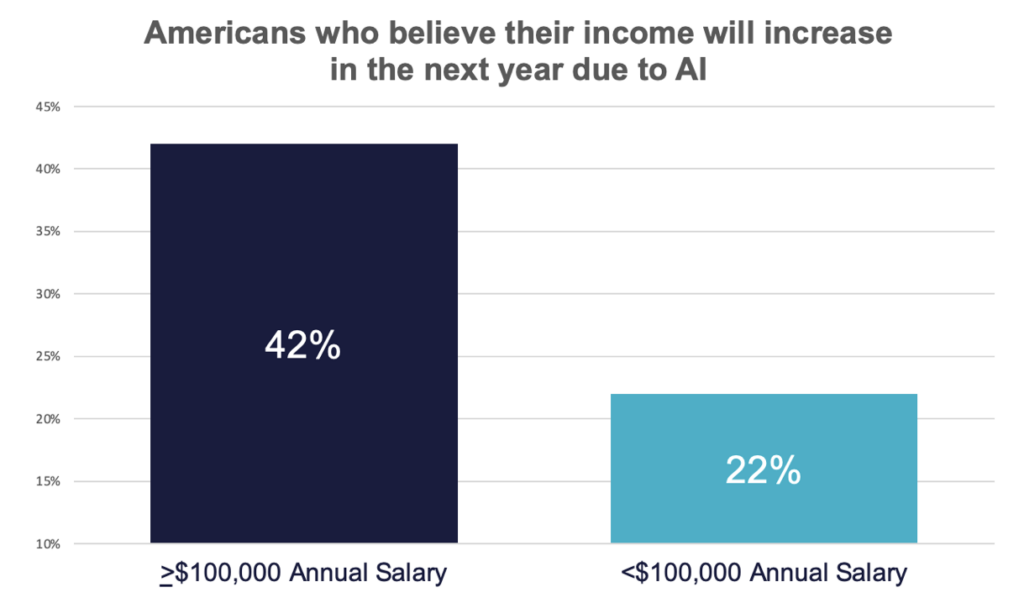

- 42% of American workers making at least $100,000 per year believe generative A.I. will lead them to make more money in the next year—compared to just 22% of workers whose salaries are under $100,000.

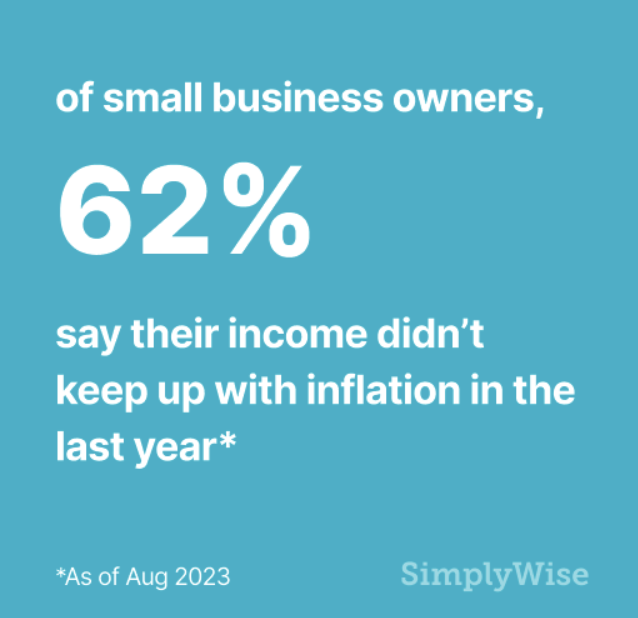

- 62% of SBOs reported their income did not keep up with inflation over the last year, and 60% believe their income will still not keep up with inflation in the next 12 months.

- 40% of SBOs worry the US/China relationship will negatively impact their business operations over the next year.

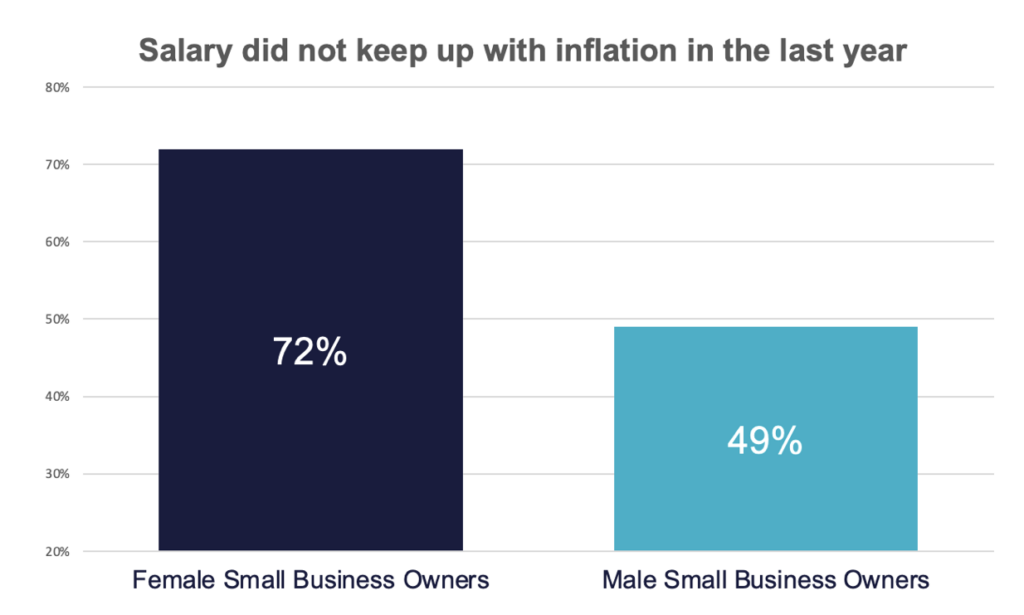

- 74% of female SBOs (compared to 41% of male SBOs) feel their income has failed to keep up with inflation over the past year.

Small Businesses and Workers Question the Economic Impact of A.I. in the Short Term

Generative A.I. is poised to have a significant impact on the American workforce, shaping various aspects of how people work, create, and collaborate. As this technology advances, it introduces both opportunities and challenges that will influence the way businesses and individuals operate.

The SimplyWise survey found that of working Americans, SBOs are more optimistic on A.I. In fact, 40% of SBOs believe that advances in A.I. will lead to an increase in their income within the next year. This is in contrast to the rest of the workforce, just 31% of whom believe A.I. will improve their income. However, the majority of both groups (45% of SBOs and 53% of non-SBOs) believed A.I. would not have any impact on their income in the next year.

The data suggests that SBOs see some opportunity in A.I. for enhanced profitability—whether by increasing efficiency through the automation of day-to-day operations, or the implementation of A.I. in their own service or product. However, most of the workforce isn’t too concerned about the impact of the technology on them personally, at least in the short term.

While recent advancements in A.I. are often reported as a greater threat to white collar jobs, the SimplyWise survey also found that for both SBOs and non-SBOs, Americans making over $100,000 per year see themselves as more likely to benefit from advancements in A.I.. In fact, 42% of American workers making at least $100,000 per year believe generative A.I. will lead them to make more money in the next year—compared to just 22% of workers whose salaries are under $100,000. It appears that most high-income workers believe A.I. will help make them more effective and efficient in their job or business, as opposed to a tool that threatens to replace their work.

Inflation Continues to Squeeze the Workforce, Especially Women

Continuing inflation and economic uncertainty is impacting Americans across the workforce. Despite signs of cooling, the past year was challenging both for SBOs and the rest of American workers. The SimplyWise data found that for 62% of SBOs, their income was not able to keep up with inflation over the last year. And 60% believe that will continue in the next year. Inflationary trends make running a business more expensive, impacting SBOs’ ability to hire, invest in their business, and plan for future growth.

The data was very similar for the rest of the workforce: 65% of American workers reported their wages did not keep pace with inflation over the last year. And despite recent news about pay raises starting to outpace consumer prices, 61% of workers believe that in the next twelve months, their income will still not be able to keep up with inflation.

While SBOs and the rest of the workforce both remain pessimistic about inflation and its impact on their future earnings, there was a marked gender divide in the inflationary outlook. While women created about half of new U.S. businesses for the third year in a row in 2022, the SimplyWise survey found that 72% of female business owners felt their income failed to keep up with inflation over the past year. This is in comparison to male business owners, just 49% of whom felt their income failed to keep up.

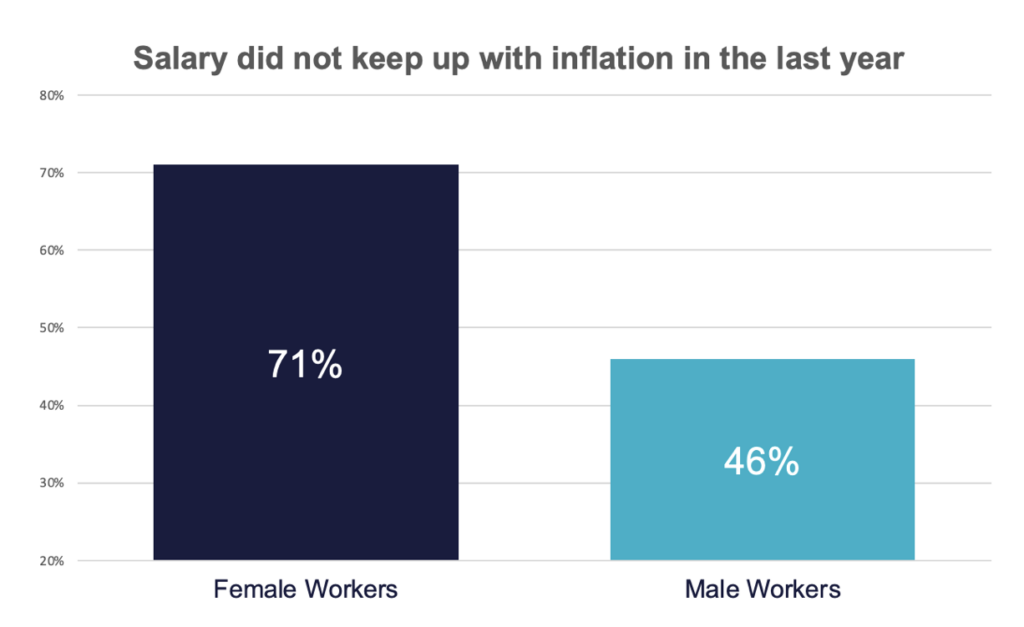

Again, the numbers were similar for the rest of the workforce. Of non-SBOs, 71% of women compared to 46% of men did not feel their income kept pace with inflation in the last year.

Workers Worry About Geopolitics, Particularly Small Business Owners

Beyond the rapidly changing technological landscape and inflation, SBOs are also dealing with an increasingly uncertain political environment fueled by a divisive upcoming U.S. election, global tensions, and international competition.

Small business owners are more concerned than the rest of the workforce about global relations. Specifically, SBOs are more concerned than the rest of the workforce about the impact of Russia on the global stage. Of SBOs, 42% believe Russia will have a negative effect on their business in the next year, compared to 33% of the rest of the workforce. The Russian invasion of Ukraine has disrupted supply chains on which SBOs rely, impacted energy prices, and raised the threat of cyberattacks in the U.S., among other issues.

SBOs are slightly less concerned about China than Russia – but also more concerned about China than the rest of the workforce. For SBOs, 37% believe relations with China will negatively impact their business in the next 12 months, compared to 32% of workers.

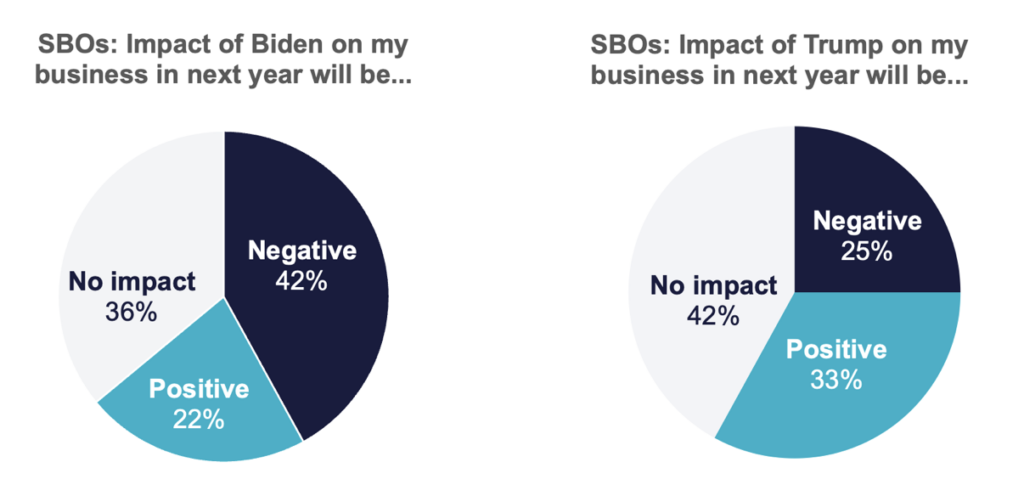

Back at home, the U.S. workforce is dealing with a looming national election that could have a significant impact on their economic stability and work environment. Surveys regularly find that more small-business owners—who prioritize lower taxes and decreased regulations when they go to the polls—identify as Republican (41%) than Democratic (23%). Then it is perhaps little surprise that the SimplyWise data found that SBOs are more positive about Trump than about Biden when it comes to the future of their business. In fact, 33% of SBOs said they believe that Former President Trump will have a positive impact on their business in the next year—compared to 22% of SBOs who believe President Biden will have a positive impact.

The data showed that the rest of the workforce was also slightly more positive on Trump than Biden when it comes to the impact to their work; 30% in favor of Trump compared to 27% in favor of Biden.

There have been significant changes to the tax code in the last six years—particularly with the 2017 Tax Cuts and Jobs Act which reduced tax rates for businesses and individuals, increased the standard deduction and family tax credits, and repealed personal exemptions, making it less beneficial to itemize deductions. As these changes have largely coincided with the surge in new business formation following the pandemic, taxes have become a source of even greater confusion for Americans.

Maintaining comprehensive records of all business expenses, regardless of whether they are fully or partially connected to the business, is essential for proper tax management. Regardless of the current political environment, it’s important for all Americans to be prepared with proper tax prep by staying on top of their finances and financial records.

A receipt scanner or bill organizer can help SBOs and workers track expenses for accounting and tax time. Expense tracker products like SimplyWise are used by small businesses and households across the country to scan receipts, invoices and other important paperwork. Having everything organized in one place, easily accessible, is critical to staying smart with one’s finances.